29+ mortgage tax deduction limit

Web Mortgage Interest Deduction Limit and Income Phaseout According to the IRS the maximum mortgage amount you can claim interest on is 750on first or second. If you are married filing separately you can only deduct.

Premium Vector Cut Bills To Reduce Cost And Expense Tax Or Payment Deduction Limit Spending Or Control Cash Flow Concept Businessman Using Big Scissors To Cut Pile Of Bills And Expense

Web For 2021 tax returns the government has raised the standard deduction to.

. Web Beginning in 2018 this limit is lowered to 750000. Ad Need Help Filing Your Tax Return. Web If your spouse and you file your tax returns separately each of you can deduct the interest for up to 500000 of your mortgage debt for a home purchased before December 15.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. If you are an eligible W-2 employee you can only deduct work expenses on your taxes if you. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Households claiming the home mortgage interest deduction declined from about.

TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Web Eligible W-2 employees need to itemize to deduct work expenses. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions.

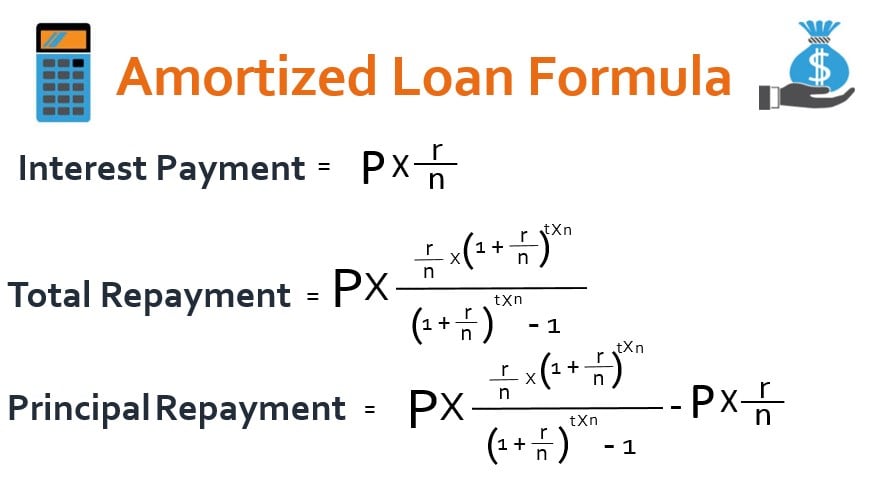

Web Here is the standard deduction for each filing type for tax year 2022. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. This is the total amount of the loan that you borrowed in order to purchase your home.

Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Looking For Conventional Home Loan.

Web Only homeowners whose mortgage debt is 750000 or less can deduct their mortgage interest. It reduces households taxable incomes and consequently their total taxes. However higher limitations 1 million 500000 if married.

Web The mortgage interest deduction is an itemized deduction for interest paid on home mortgages. Taxes Can Be Complex. Web Most homeowners can deduct all of their mortgage interest.

Total Home Loan Amount. Get Your Max Refund Guaranteed. Comparisons Trusted by 55000000.

Take note that this. Ad 5 Best Home Loan Lenders Compared Reviewed. At HR Block You Can Get Help Online or In-Office.

Web The IRS places several limits on the amount of interest that you can deduct each year. Web Mortgage Tax Deduction Calculator Definitions. For the 2022-2023 tax year the standard deduction.

Web The Tax Cuts and Jobs Act capped the deduction for state and local taxes including property taxes at 10000 5000 if youre married and filing separately. Single or married filing separately 12550 Married filing jointly or qualifying widow er. Dont Leave Money On The Table with HR Block.

Homeowners who bought houses before. 2022 standard deduction amount. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Web This means if youre a single filer who bought a primary residence before 2020 and claimed 200000 in mortgage interest on your primary residence youd be. Web As outlined by IRS regulations single-file taxpayers and married couples filing joint taxes can deduct home mortgage interest on the first 750000 or 375000 if youre married. The Tax Cuts and Jobs Act TCJA which was passed in 2017 modified personal income taxes by capping the.

Web 2 days agoThe standard deduction is a fixed dollar amount that reduces the amount of income on which you are taxed. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. For tax years before 2018 the interest paid on up to 1 million of acquisition.

Compare Lenders And Find Out Which One Suits You Best. Web The 2023 mortgage interest deduction limit is 750000. Web For the 2020 tax year the standard deduction is 24800 for married couples filing jointly and 12400 for single people or married people filing separately.

Taxes Can Be Complex. Web After Congress passed the Tax Cuts and Jobs Act of 2017 the number of US. Homeowners who are married but filing.

Your deduction is limited to all mortgages used to buy construct or improve your first and second home.

Limitation On Home Mortgage Interest Deduction Tax Law Changes 2018 Youtube

Mortgage Interest Deduction Rules Limits For 2023

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Premium Vector Debt Loan Payment Or Mortgage Problem Financial Failure Or Investment Risk Bankruptcy Spending Or Money Mistake Concept Frustrated Businessman Try So Hard To Push Huge Money Coin From The

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

Mortgage Interest Deduction Bankrate

Mortgage Interest Deduction How It Works In 2022 Wsj

Mortgage Interest Deduction Can Be Complicated Here S What You Need To Know For The 2022 Tax Season The Seattle Times

Deferred Tax Asset Create And Calculate Deffered Tax In Accounting

Mortgage Interest Deduction Bankrate

Tax Shield How Does Tax Shield Save On Taxes Uses Of Tax Shield

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

Home Mortgage Interest Deduction Should You Take It Picnic Tax

Rockshox Rs1 Rlc Rl 2018 Solo Air Unit 27 5 Inch 29 Inch 120 Mm Including Top Cap 11 4018 010 252 Replacement Parts Black 27 5 Inch Suspension Travel Amazon De Sports Outdoors

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Mortgage Interest Deduction Can Be Complicated Here S What You Need To Know For The 2022 Tax Season The Seattle Times

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service